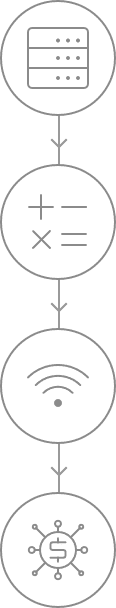

Trading server

Aggregated quotation

Order transmission

Liquidity pool

Trading is proving exceedingly hard, perhaps a final push is needed.Unparalleled market access level.Ultra-low latency IT infrastructure

Reliable Data Transmission Success Rate

98.75%

Order Execution Time as low as

20ms

Dedicated Fiber Optic Network At Least

100MbpsReliable Data Transmission Success Rate

Order Execution Time as low as

Dedicated Fiber Optic Network At Least

Technology empowers trading

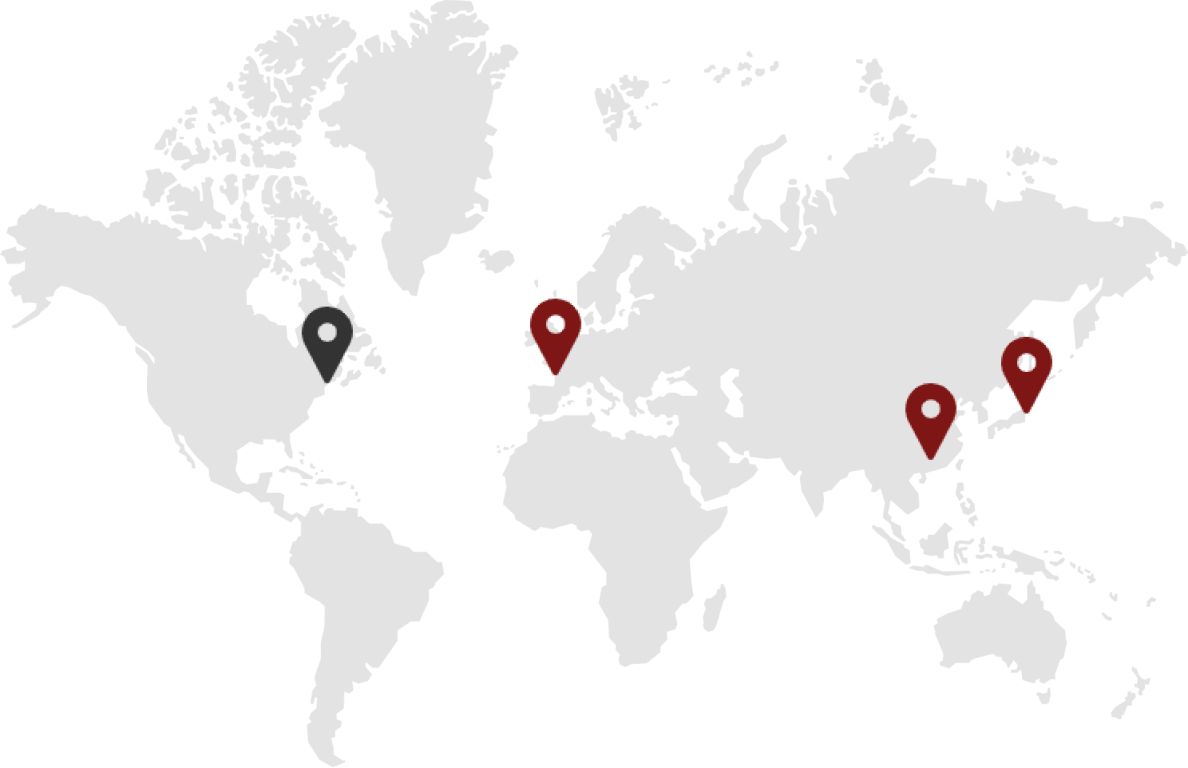

Best-trader dedicated servers are set up in Equinix LD4, HK3, TY3, NY4 to build worldwide coverage for the financial ecosystem.

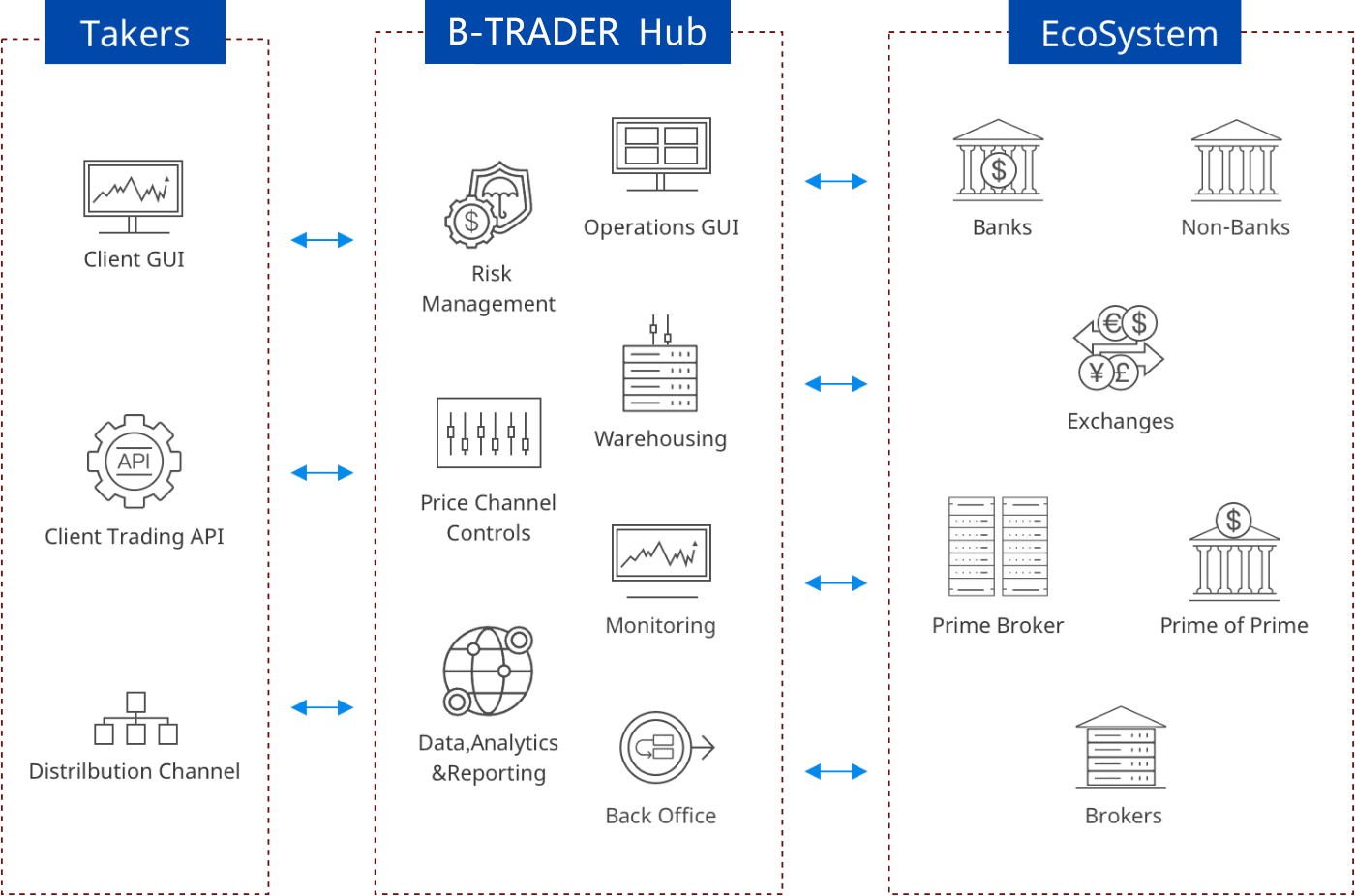

Discover Prices & Transfer Orders

Best-trader uses FIX (Financial Information Exchange Protocol) to aggregate interbank currency quotes to provide customers with direct access to the markets with optimum liquidity. The quotes aggregated through dedicated physical HUB hardware bring lower spreads and sustainable trading opportunities.

Professional and leading financial technology makes trading with infinite possibilities

POSSIBILITY

We ensure the best liquidity in the trading market, so that you may achieve more flexibility, while obtaining more Multi–Asset Liquidity .

We ensure the best liquidity in the trading market, so that you may achieve more flexibility, while obtaining more Multi–Asset Liquidity .

Minimizing risks and maximizing trading opportunities

Best-trader's ultra-low delay aggregation, intelligent order routing and quotation optimization engine provide you with higher reliability and optimum order execution.

Trading server

Aggregated quotation

Order transmission

Liquidity pool

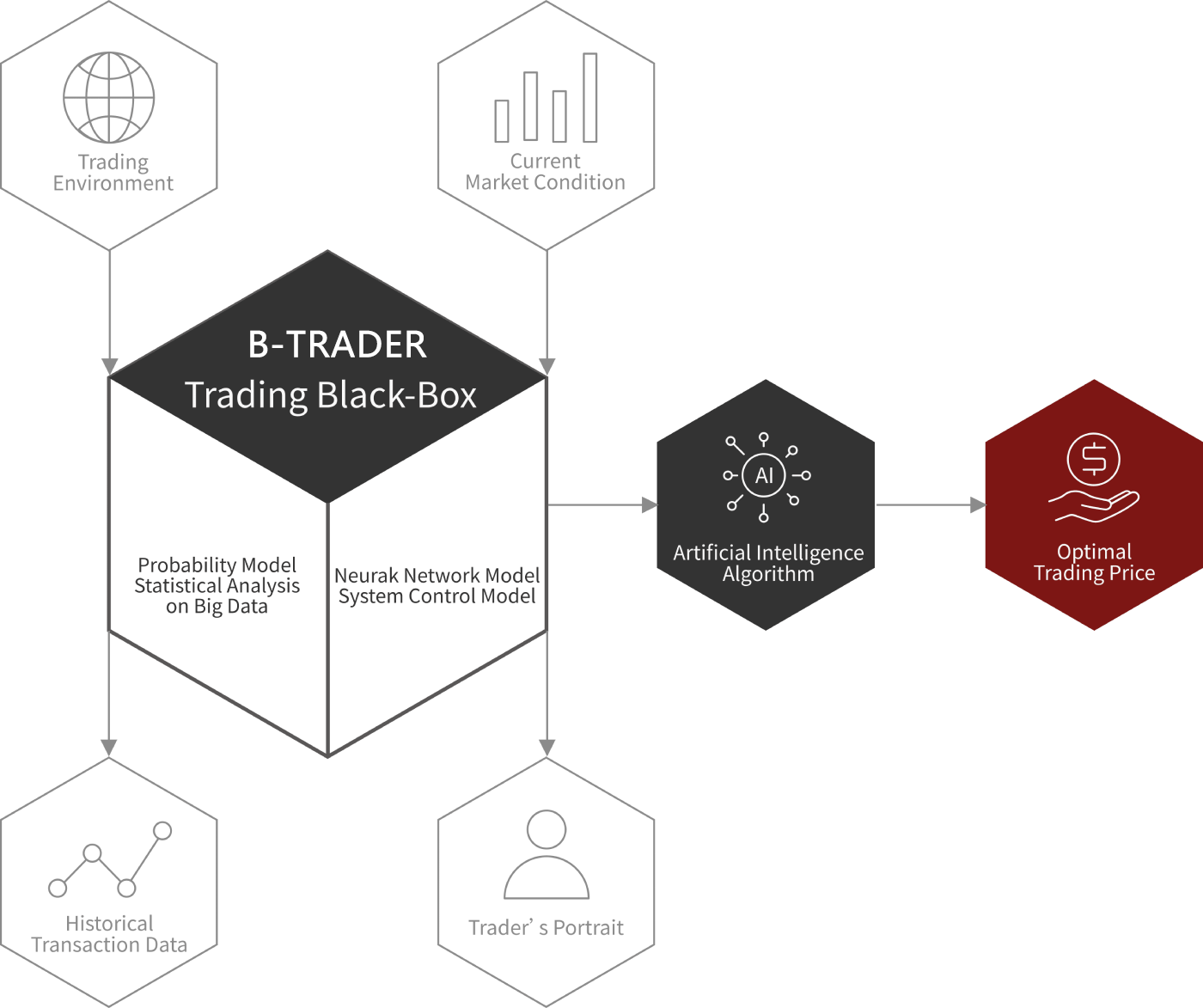

Trading Black-Box

Enabling more than 85% of orders filled at a better price

Best-trader trading black box, based on tens of millions of historical trading data, traders'trading habits,user attributes and other portraits,the current market situation and trading network environment,uses big data statistical analysis,probability model,neural network model,system control theory model and artificial intelligence algorithm to conduct comprehensive research and judgment,and finally matches the LP that is more suitable for each trader's attributes, Achieve the best transaction price

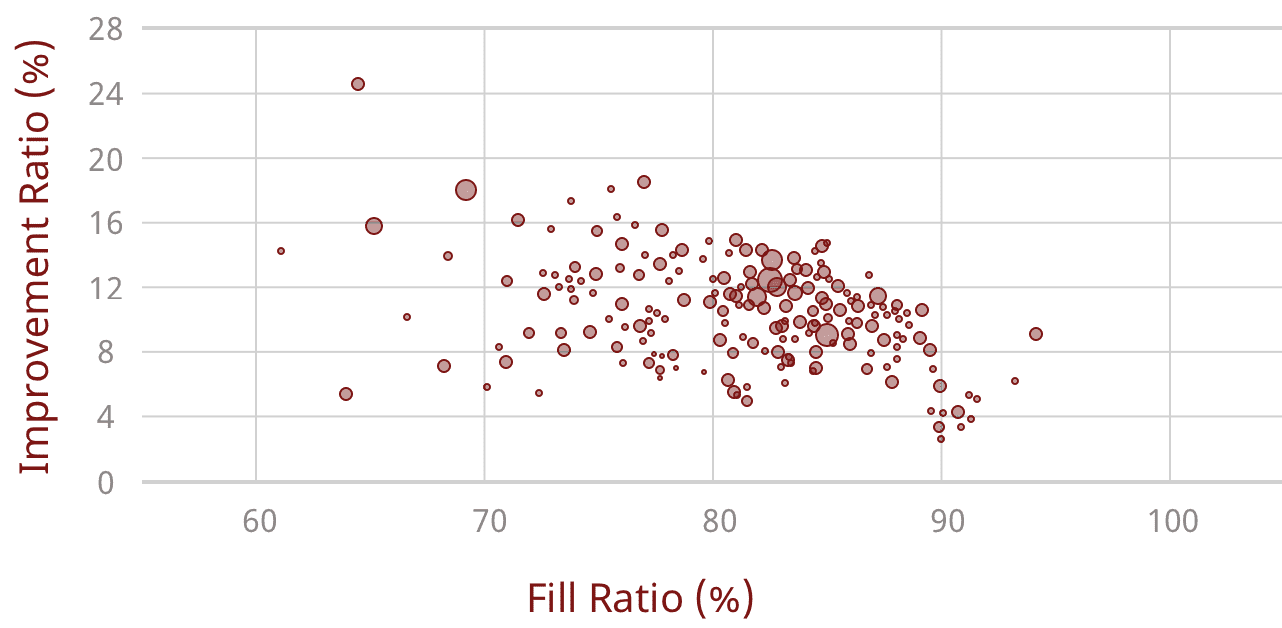

The following distribution diagram demonstrates the comparing results between Best-trader trading black box and traditional trading system (containing at least 100 orders):

This experience confirmed that Best-trader trading black-box is far superior to the traditional trading system in terms of price optimization rate, order transaction rate and algorithm stability.